Equipment Depreciation Life Macrs . This means that the business can take larger. The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. Macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. Depending on the type of property, the useful life can range from 3 to 50 years. Macrs provides for a practical approach to. Macrs is a depreciation method most applicable in cases where the assets would be used up more in the initial years of their life. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states.

from www.youtube.com

Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset. Macrs is a depreciation method most applicable in cases where the assets would be used up more in the initial years of their life. Macrs provides for a practical approach to. The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states. This means that the business can take larger. The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. Depending on the type of property, the useful life can range from 3 to 50 years. Macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. The macrs depreciation method allows greater accelerated depreciation over the life of the asset.

Lesson 7 video 6 Modified Accelerated Cost Recovery Systems (MACRS

Equipment Depreciation Life Macrs This means that the business can take larger. The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. Macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset. Depending on the type of property, the useful life can range from 3 to 50 years. Macrs is a depreciation method most applicable in cases where the assets would be used up more in the initial years of their life. This means that the business can take larger. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states. Macrs provides for a practical approach to.

From www.vrogue.co

Book Cover For Mind Mapping For Kids Book Publishes O vrogue.co Equipment Depreciation Life Macrs Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset. This means that the business can take larger. Depending on the type of property, the useful life can range from 3 to 50 years. The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states. The macrs depreciation. Equipment Depreciation Life Macrs.

From www.chegg.com

Solved An automated inspection system purchased at a cost of Equipment Depreciation Life Macrs The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. Macrs provides for a practical approach to. This means that the business can take larger. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. Macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for. Equipment Depreciation Life Macrs.

From reviewhomedecor.co

Macrs 5 Year Depreciation Table Mid Quarter Review Home Decor Equipment Depreciation Life Macrs Macrs is a depreciation method most applicable in cases where the assets would be used up more in the initial years of their life. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. Depending on the type of property, the useful life can range from 3 to 50 years. Macrs provides for a practical approach. Equipment Depreciation Life Macrs.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table Equipment Depreciation Life Macrs The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. Macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states. Understanding the modified accelerated cost recovery system. Equipment Depreciation Life Macrs.

From danieljduvallxo.blob.core.windows.net

What Is The Standard Depreciation For A Car Equipment Depreciation Life Macrs Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset. The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. Depending on the type of property, the useful life can range from 3. Equipment Depreciation Life Macrs.

From alquilercastilloshinchables.info

8 Pics Macrs Depreciation Table 2017 39 Year And View Alqu Blog Equipment Depreciation Life Macrs The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. Depending on the type of property, the useful life can range from 3 to 50 years. Macrs is a depreciation method most applicable in cases where the. Equipment Depreciation Life Macrs.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table Equipment Depreciation Life Macrs The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset. This means that the business can take larger. Depending on the type of property, the useful life can range from 3 to 50 years. The modified accelerated cost recovery system (macrs). Equipment Depreciation Life Macrs.

From www.irstaxapp.com

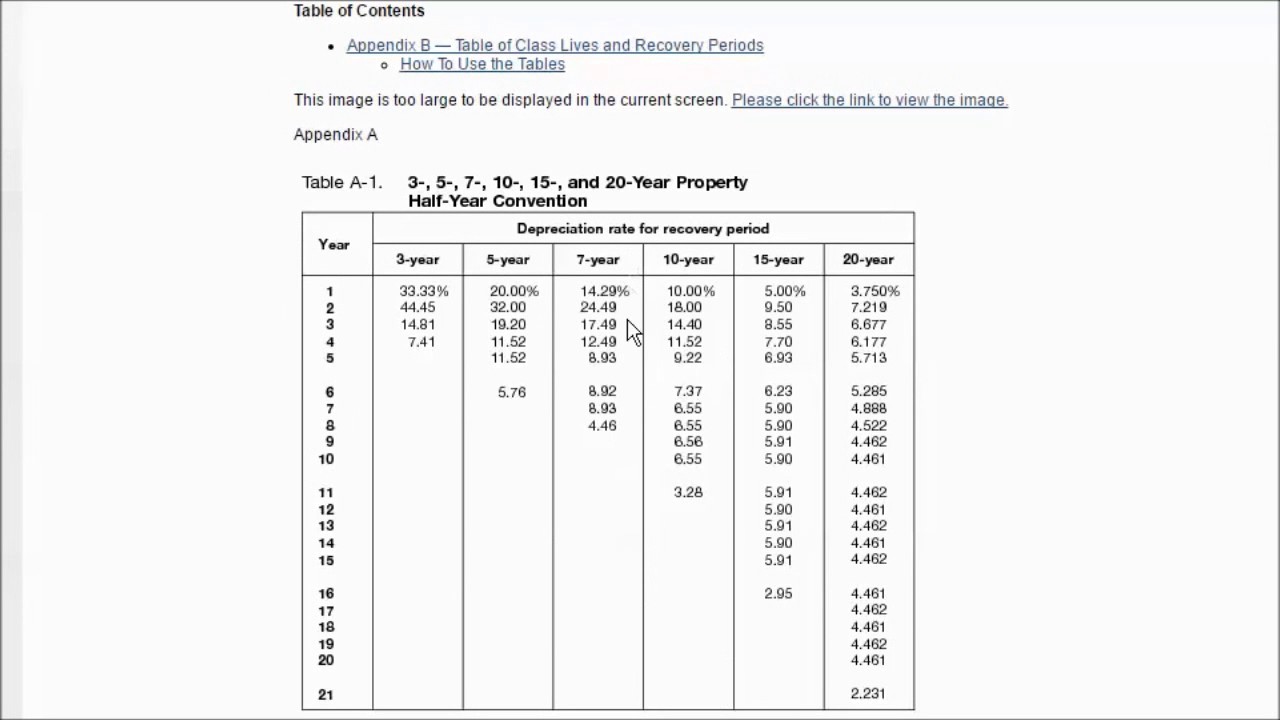

Depreciation MACRS Table for Asset's Life Internal Revenue Code Equipment Depreciation Life Macrs This means that the business can take larger. Macrs is a depreciation method most applicable in cases where the assets would be used up more in the initial years of their life. Macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. Understanding the modified accelerated cost recovery system (macrs) is. Equipment Depreciation Life Macrs.

From www.vrogue.co

The Sahara Company Purchased Equipment On January 1 2 vrogue.co Equipment Depreciation Life Macrs Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset. Macrs provides for a practical approach to. Macrs is a depreciation method most applicable in cases where the assets would be used up more in the initial years of their life. The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes. Equipment Depreciation Life Macrs.

From brokeasshome.com

Irs Depreciation Tables 2018 Equipment Depreciation Life Macrs Macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states. Macrs is a depreciation method most applicable in cases where the assets would be used up more in the initial years of. Equipment Depreciation Life Macrs.

From fitsmallbusiness.com

MACRS Depreciation Tables & How to Calculate Equipment Depreciation Life Macrs The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states. Macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. Understanding the modified accelerated cost recovery system. Equipment Depreciation Life Macrs.

From elchoroukhost.net

Macrs Ads Depreciation Table Elcho Table Equipment Depreciation Life Macrs The macrs depreciation method allows greater accelerated depreciation over the life of the asset. Macrs is a depreciation method most applicable in cases where the assets would be used up more in the initial years of their life. The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states. Understanding the modified. Equipment Depreciation Life Macrs.

From www.youtube.com

Lesson 7 video 6 Modified Accelerated Cost Recovery Systems (MACRS Equipment Depreciation Life Macrs Macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. This means that the business can take larger. Macrs is a depreciation method most applicable in cases where the assets would be used up more in the initial years of their life. The modified accelerated cost recovery system (macrs) is the. Equipment Depreciation Life Macrs.

From www.superfastcpa.com

What is MACRS Depreciation? Equipment Depreciation Life Macrs Macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset. The modified accelerated cost recovery system (macrs) is. Equipment Depreciation Life Macrs.

From solobuildingblogs.com

Section 179 vs MACRS traditional depreciation of equipment for the solo Equipment Depreciation Life Macrs Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset. The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states. Macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. Macrs provides for a practical approach to. Depending. Equipment Depreciation Life Macrs.

From elchoroukhost.net

Macrs Ads Depreciation Table Elcho Table Equipment Depreciation Life Macrs Depending on the type of property, the useful life can range from 3 to 50 years. This means that the business can take larger. Macrs is a tax depreciation method for tangible property, assigning specific recovery periods to assets for tax deduction purposes. Macrs is a depreciation method most applicable in cases where the assets would be used up more. Equipment Depreciation Life Macrs.

From www.studocu.com

Problems Depreciation 1 to 20 PROBLEMS_DEPRECIATION (1 to 20) S Equipment Depreciation Life Macrs The macrs depreciation method allows greater accelerated depreciation over the life of the asset. Depending on the type of property, the useful life can range from 3 to 50 years. Macrs provides for a practical approach to. The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. Macrs is a depreciation method most applicable in. Equipment Depreciation Life Macrs.

From youngandtheinvested.com

MACRS Depreciation Table Guidance, Calculator + More Equipment Depreciation Life Macrs Macrs is a depreciation method most applicable in cases where the assets would be used up more in the initial years of their life. The modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states. This means that the business can take larger. Depending on the type of property, the useful life. Equipment Depreciation Life Macrs.